IMPORTANT NOTE – As of January 1, 2025, this tax credit is scheduled to expire UNLESS the State Legislature decides to renew it. Anything donated before 12/31/24 will be eligible for the tax credit, but anything after that date may not be eligible. We will update this webpage once more information is made available.

Within the State of Missouri, under statute 135.621, a qualified Diaper Bank can give tax credits to individuals or businesses who donate $100 or more to the Pooper Troopers. This tax credit is worth 50% of the donation, with a max credit of $50,000 per individual or donation.

If you have donated $100 or more to the Pooper Troopers and wish to take advantage of the tax credit, please follow the directions below.

- Step 1 – Download the pre-populated form by following this link.

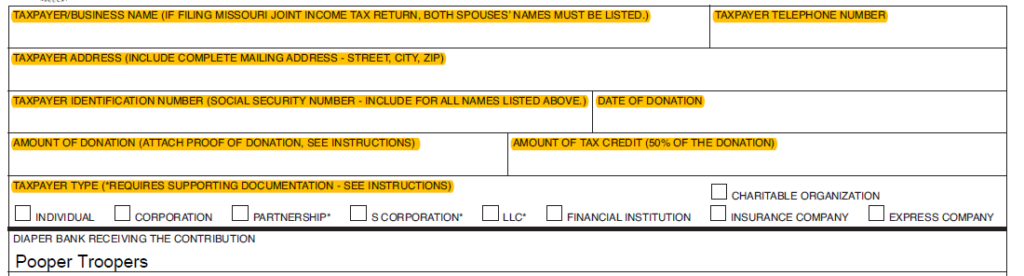

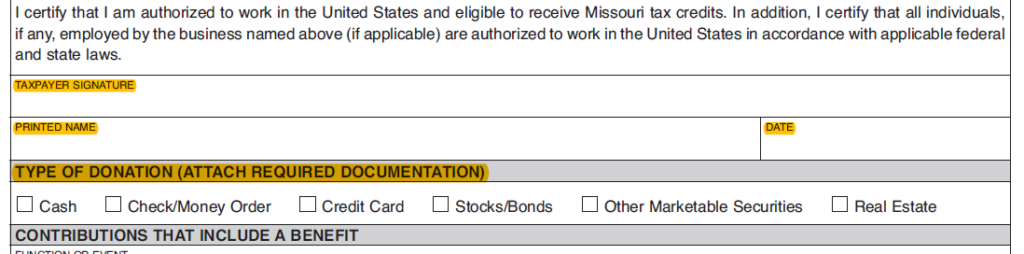

- Step 2 – Fill in all HIGHLIGHTED areas. Please note that everything you need to fill in is on page 1 and you MUST provide an original signature (can not be a digital signature or photocopy). If not an original signature, the state will decline it!

- Step 3 – Print the completed form.

- Step 4 – Mail the completed form to the following address:

Pooper Troopers

1600 Bruder Court

St Paul, MO. 63366

- Step 5 – After we receive the form, we will complete our portion and mail the package including verification of donation to the State. We will then email you a copy of all documentation for your records.

- Step 6 – Sit back and wait for confirmation from the State of Missouri! They usually respond within 45 days. Be sure to include this in your taxes when you talk to your CPA!

Please send us an email should you have any questions or concerns, we are happy to help! [email protected]

For additional information about this tax credit from the State of Missouri, please visit the Diaper Bank Tax Credit page at the Missouri Social Services website.